Expert Tips for Effective Bookkeeping Spay050

Effective bookkeeping is essential for business success. It requires a structured approach to managing financial records. Implementing a consistent record-keeping system is a fundamental step. Additionally, leveraging accounting software can enhance efficiency and accuracy. Regular reconciliation of accounts ensures transparency. Staying updated on tax regulations is vital for maximizing deductions. These strategies form the foundation of sound financial management. However, there are further nuances that can significantly impact overall effectiveness.

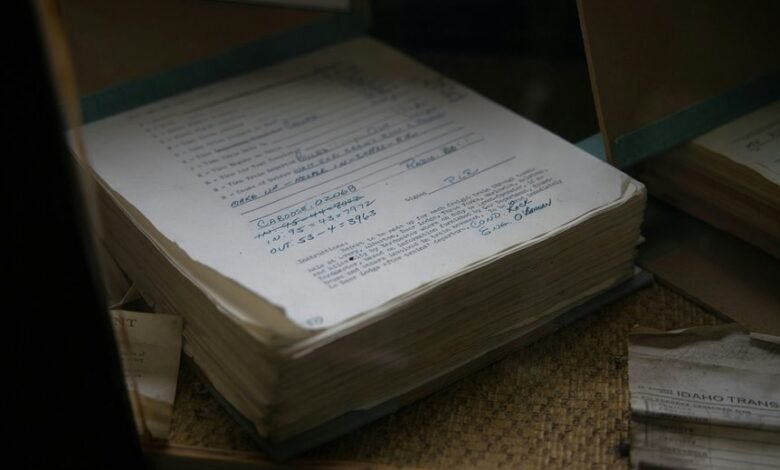

Establish a Consistent Record-Keeping System

Establishing a consistent record-keeping system is essential for effective bookkeeping practices. Proper record organization enhances clarity and accessibility, enabling business owners to make informed decisions.

Effective documentation methods, such as categorizing transactions and maintaining digital backups, further streamline processes. This structured approach not only safeguards financial data but also empowers individuals to exercise greater control over their financial landscape, fostering a sense of autonomy.

Utilize Accounting Software for Efficiency

A significant number of businesses find that utilizing accounting software enhances operational efficiency and accuracy in financial management.

By leveraging cloud solutions, organizations can access real-time data from anywhere, facilitating informed decision-making.

Furthermore, effective software integration streamlines processes, reducing manual errors and saving time.

This technological advancement empowers companies to focus on growth while maintaining financial integrity and transparency.

Regularly Reconcile Your Accounts

Reconciliation of accounts serves as a critical practice in maintaining financial accuracy and integrity.

Through systematic account analysis, discrepancies can be identified and rectified, ensuring that financial records align with actual transactions. This diligence fosters transparency and accountability, empowering businesses to make informed decisions.

Regularly reconciling accounts not only enhances financial accuracy but also supports overall organizational freedom and efficiency.

Stay Informed About Tax Regulations and Deductions

Maintaining accurate financial records through regular account reconciliation lays the groundwork for effective tax management.

Staying informed about tax updates ensures that individuals and businesses can implement optimal deduction strategies.

By actively monitoring changes in tax regulations, one can identify potential deductions and avoid costly penalties.

This proactive approach fosters financial freedom while enhancing overall compliance and reducing tax liabilities.

Conclusion

In conclusion, implementing expert bookkeeping practices can significantly enhance a business's financial health. For instance, a small retail store that adopted a consistent record-keeping system and utilized accounting software saw a 30% reduction in financial errors over six months, allowing for more accurate budgeting and improved cash flow management. By regularly reconciling accounts and staying informed about tax regulations, businesses can optimize their operations, ensuring compliance and maximizing their financial potential.