Financial Growth With Bookkeeping Resonanceenter1

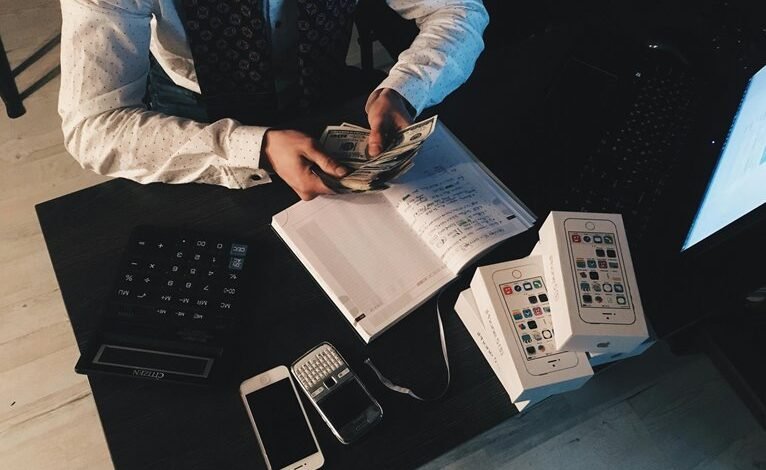

Accurate bookkeeping is essential for financial growth. It provides a clear picture of an organization's financial health. By implementing technology, businesses can streamline processes and minimize errors. This efficiency allows for better resource allocation and strategic decision-making. However, understanding the key metrics that drive sustainable growth remains a critical challenge. How organizations align their financial strategies with overarching business objectives may reveal insights that are pivotal for long-term success.

The Importance of Accurate Bookkeeping for Financial Growth

Accurate bookkeeping serves as the backbone of financial growth for any organization.

Financial accuracy ensures that resources are allocated efficiently, revealing insights into spending patterns and revenue streams.

Mastering bookkeeping essentials empowers businesses to make informed decisions, fostering an environment where financial freedom can flourish.

Ultimately, precise records enable organizations to navigate complexities, adapt to changes, and seize opportunities for sustained growth.

Leveraging Technology for Enhanced Bookkeeping Practices

As businesses increasingly embrace digital solutions, leveraging technology for enhanced bookkeeping practices has become essential for maintaining financial integrity and efficiency.

Cloud solutions facilitate real-time access to financial data, promoting transparency and collaboration.

Meanwhile, automation tools streamline routine tasks, reducing human error and freeing resources for strategic analysis.

Together, these technologies empower businesses to achieve greater financial resilience and operational effectiveness.

Key Metrics to Monitor for Sustainable Growth

Utilizing technology in bookkeeping not only enhances operational efficiency but also lays the groundwork for monitoring key metrics that drive sustainable growth.

Essential metrics include profit margins and cash flow, which provide insights into financial health and operational effectiveness.

Aligning Financial Strategies With Business Objectives

Effective alignment of financial strategies with overarching business objectives is crucial for maximizing organizational performance.

Achieving financial alignment ensures that resources are allocated efficiently, facilitating strategic budgeting that directly supports long-term goals.

Conclusion

In the ever-evolving landscape of business, accurate bookkeeping emerges as the steadfast lighthouse guiding organizations through the tumultuous seas of financial uncertainty. By harnessing technology and aligning strategies with objectives, companies can navigate toward sustainable growth. Just as the fabled phoenix rises from the ashes, so too can businesses achieve resilience and prosperity through meticulous financial management. Ultimately, the integration of precise bookkeeping practices not only safeguards resources but also illuminates the path to enduring success in a competitive market.